It’s terrible to go outside for a swim in your pool only to find that its once-generous depth has decreased by one foot. It’s not fun to deal with, but the solution is straightforward if you know what to look for.

Leaks are more likely in older pools because the surface has worn down. They may have developed cracks from constant use. This begs you to ask, “are pool leaks covered by homeowners insurance?”

Your homeowner’s insurance will cover the damage if it falls under the peril damages list. Your coverage may also fall under “other structures,” depending on the specifics of your insurance. These perils can include:

- Fire

- Windstorm

- Hail

- Lightning

- Vandalism

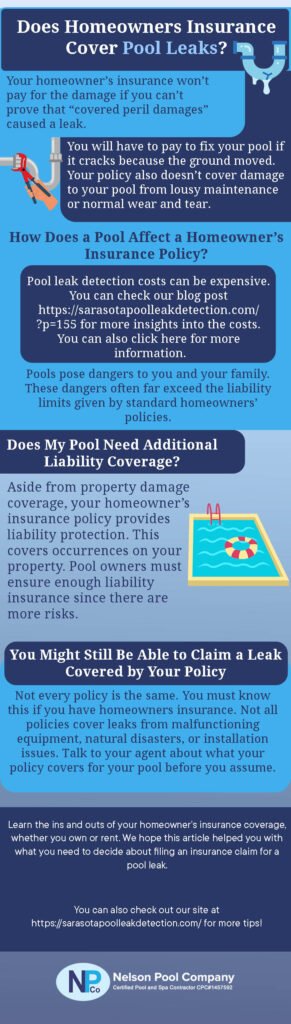

Does Homeowners Insurance Cover Pool Leaks?

Above-ground pools are not immune to leaks any more than their in-ground counterparts. The cause of the leak matters. Your homeowner’s insurance won’t pay for the damage if you can’t prove that “covered peril damages” caused a leak.

For example, your home insurance won’t pay to fix if a storm causes a tree to fall and damage your pool. A standard homeowners policy does not cover damage caused by earthquakes.

You will have to pay to fix your pool if it cracks because the ground moved. Your policy also doesn’t cover damage to your pool from lousy maintenance or normal wear and tear.

Leaking pool water is one of the most common causes of home insurance claims. These can be very expensive to repair. Coverage is different in each state, so check your policy for specifics.

How Does a Pool Affect a Homeowner’s Insurance Policy?

Pool leak detection costs can be expensive. You can check our blog post https://sarasotapoolleakdetection.com/?p=155 for more insights into the costs. You can also click here for more information.

Now, you are fortunate if your home insurance policy includes coverage for your pool as it may protect you from liability.

For instance, your policy will cover the pool if you have it in your background and someone gets hurt. The main drawback is that these constraints might not cover the person’s medical needs.

Pools pose dangers to you and your family. These dangers often far exceed the liability limits given by standard homeowners’ policies. You might need to boost your house insurance policy’s coverage to $300,000 from the typical $100,000 for peace of mind. You could get umbrella coverage in case it is still insufficient.

Often, your homeowner’s insurance aids in preventing damage to your property. The most frequent sorts of damage that homeowner’s insurance policies cover are the following:

- Theft

- Vandalism

- Lightning

- Frozen pipes

Some homeowners’ insurance policies cover wind, hurricane, and fire damage. Unfortunately, they are not the kind of things that often harm a backyard pool. Pool damage is often brought on by earthquakes or maintenance problems. House insurance policies cover neither of these.

Does My Pool Need Additional Liability Coverage?

Aside from property damage coverage, your homeowner’s insurance policy provides liability protection. This covers occurrences on your property. Pool owners must ensure enough liability insurance since there are more risks.

Liability limits of $300,000 to $500,000 (or more) are what most insurance companies recommend.

You might want to consider getting an umbrella policy. This is different from the standard liability and damage coverage of your policy. This can protect your assets from damages beyond your primary policy’s limits.

Any accident that occurs on your property falls under your responsibility. Umbrella coverage is something to consider if you have a pool in your background. It qualifies you for savings if you get policies from the same insurer. Inquire about bundling your coverage with your insurance agent.

Are There Differences in Coverage Between Above-Ground and In-Ground Pools?

Generally, the sort of pool in your yard will affect the homeowner’s insurance coverage. As for damage, personal property or “other structures” cover an above-ground pool. But, in-ground pools are part of your dwelling or “other structures” coverage.

Consult your insurance agent in this situation. Find out if your property limits are enough to pay for the repair of your above-ground pool in the event of damage.

The rules are the same when it comes to liability insurance. You must abide by local and state standards about pool ownership, no matter what kind of pool you have.

Other safety precautions include:

- Making sure the pool deck isn’t slippery

- Putting up a fence around the pool area to keep small children out

- Using diving boards and slides with extra care.

Homeowner’s insurance can be hard to understand. This is true, especially when you have something unique in your yard, like a pool. We can help you explore your coverage requirements. Call us to get yourself familiarized with homeowners insurance pool damages coverage.

Please include attribution to https://sarasotapoolleakdetection.com with this graphic.

You Might Still Be Able to Claim a Leak Covered by Your Policy

Not every policy is the same. You must know this if you have homeowners insurance. Not all policies cover leaks from malfunctioning equipment, natural disasters, or installation issues. Talk to your agent about what your policy covers for your pool before you assume.

There are other ways to make sure this doesn’t happen if you don’t think your policy covers the leak or if they can’t tell.

Final Thoughts

Learn the ins and outs of your homeowner’s insurance coverage, whether you own or rent. We hope this article helped you with what you need to decide about filing an insurance claim for a pool leak.

Call (561) 570-1269 to schedule a pool inspection in your area. Our team will schedule a time convenient for you to stop by to give you an idea of your pool’s current state. Or you can fill out this form, and we will have the best pool renovation company in your area contact you!

In case you can not view this video here, please click the link below to view Are Pool Leaks Covered By Homeowners Insurance? on my YouTube channel: https://www.youtube.com/watch?v=BVHK1kvUsGA.